Understanding Business Structures in India

21 July 2022

In the first of a series of articles, Priyank Kukreja from member Coinmen Consultants in New Delhi, India, explains the different types of business structures in the country and the importance of choosing the correct one to align with your business idea.

Have a business idea and want to become an entrepreneur – What do you do next?

When starting out on any business venture, it is essential to choose a business structure that is aptly suitable to your mission and vision.

This article sets out the different types of entity structures, with an understanding about each structure so one can make an educated decision before turning any idea into reality.

Different Types of Business Structures:

Before proceeding with any business idea, a plan is necessary and the management, control, and scalability of the business idea greatly depends upon choosing the right business structure.

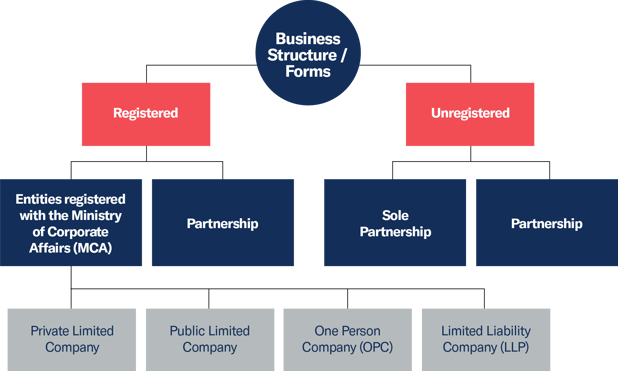

Below is the tabular representation of the various business structures available in India:

The business structure we choose plays a crucial role in influencing everything from operations to taxes, including the risk associated to your personal assets. Therefore, it is important to choose a business structure that gives an optimum measure of risk and rewards.

Business structures in India are divided into:

1) Registered Business.

When considering your goals and path chosen of doing business, it is always advisable to register the business with the statutory authorities before starting your business.

For instance, you will want to reap the benefits of obtaining government grants or government funding under the start-up India initiative of the Department for Promotion of Industry and Internal Trade. You can only avail such benefits through a private limited company or a limited liability partnership since the business structure as specified herein has been classified as a mandatory requirement.

Below is an overview of the different types of registered business:

- One Person Company (OPC) - an OPC is a company limited by share capital and is registered under the Companies Act 2013 and means a company which has only one person as a member.

- Private Limited Company - this is a company limited by share capital, registered under the Companies Act 2013 and/or any other companies act with a minimum of two members and which by its articles:

-

- restricts the right to transfer its shares

- except in a one person company where it limits the number of its members to a maximum of two hundred

- prohibits any invitation to the public to subscribe for any securities of the company.

- Public Limited Company - a company limited by share capital, registered under the Companies Act 2013 and/ or any erstwhile companies Act with a minimum number of members as Seven (7) and not restricted plus it has more flexible clauses unlike the private company.

- Limited Liability Partnership - a partnership of two or more legal entities plus limited liability. Such partnerships are registered under the Limited Liability Partnership Act 2008.

- Registered Partnership - a partnership of two or more legal entities with unlimited liability and is governed by the written deed. Such partnerships are registered under the Indian Partnership Act 1932, as amended from time to time.

2) Unregistered Business

Unregistered businesses are usually associated with the unorganized sector in any country, and it is not always advisable to not get the business registered due to its features of unlimited liability and risk associated with respect to its continuity.

The two types of unregistered businesses are:

- Unregistered Partnership - a partnership of two or more legal entities with unlimited liability and can be governed by written or oral deed.

- Sole Proprietorship - a business structure where there is no distinction between the owner and the business. The business is owned and run by an individual and is the most prevalent form of business in this sector in India.

For more information about which business sector is best for your business please contact Nitin Garg nitin@coinmen.com in the first instance.

Further Reading:

Q&A with Varun Garg, Senior Consultant at Coinmen Consultants

APAC Conference Brings AGA Members Together Again in Singapore

Coinmen Consultants join Alliott Global Alliance in India

About Coinmen Consultants LLP:

Founded in 2010, Coinmen is a financial and business consulting firm established by three visionary Partners Vikrant Suri, Mohit Aggarwal, and Nitin Garg, following their respected careers in the Big 4 accounting firms and successful individual paths. Eleven years later, they now have a team of 75 and 5 Partners. Based in Delhi and Gurugram, the firm has a strong consulting practice and international orientation, with Japanese, Italian, Korean, and Spanish desks.