Global mobility case study: Solving the complex compliance issues inherent in long-term assignments

04 December 2018

This case study demonstrates why the management of expatriates on long-term assignments needs solutions that combine tax, legal and immigration advice.

International assignments have become common practice within multinational companies. Nevertheless, they remain challenging exercises in terms of (at least) ensuring compliance with legal requirements in different countries. An expert panel consisting of experts from Alliott Group/Global Mobility spoke at the Forum for Expatriate Management EMEA Summit in London (8-9 November), presenting two case studies which highlighted the issues that international companies need to address in various different jurisdictions when transferring executives and the practical solutions that can be implemented with the help of our global multidisciplinary team of tax advisers and lawyers.

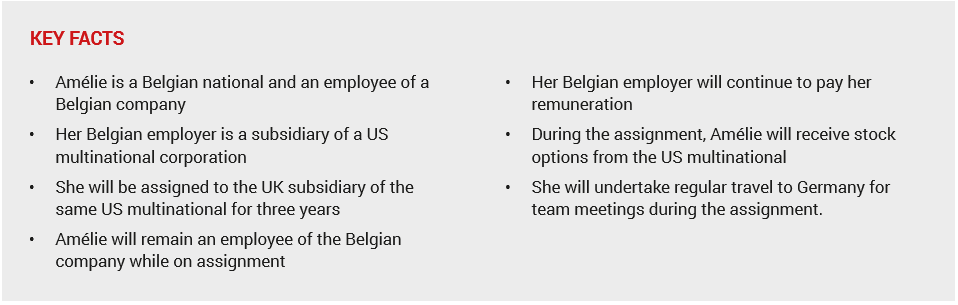

Our first case study presented by Global Mobility Specialist at Tax Consult, Belgium, Stefan Creemers. Meet Amélie, a Belgian national going on assignment to the UK for three years:

Challenges

This particular long-term assignment creates a fairly fierce compliance ‘Kraken’ - the following tentacles will need to be grappled with and tied up:

Immigration

Will Amélie be entitled to live and work in the UK? Under current EU legislation, the free movement of people allows Amélie to move to and work in the UK. However, a question mark hangs over how this will be handled after Brexit (March 29, 2019). To date, no agreement has been concluded between the UK and the EU on this issue.

Social Security

Articles 12 and 16 of the EU regulation 883/2004 outline rules on secondments and mean that Amélie can remain subject to Belgian social security while on assignment. An A1 document will need to be requested from the Belgian social security authorities. This document needs to indicate the start and end dates of the secondment. However, questions remain over whether this document (and continued submission to the Belgian social security system while on assignment in the UK) will remain valid after Brexit and will depend on the agreement that is reached.

Income Taxes

In which country will Amélie be taxed? First, the country in which Amélie will be considered tax resident needs to be determined. This will initially depend on the internal legislation of each jurisdiction. In the event of double tax residency, Article 4 of the tax treaty concluded between the UK and Belgium will need to be called upon to determine Amélie’s tax residency. The so-called ‘tie-breaker rule’ will need to be applied which takes into consideration details including Amélie’s permanent home, personal and economic relations (centre of vital interests), habitual abode, nationality, and mutual agreement.

Solutions

Scenario 1: Amélie remains a resident of Belgium

In this scenario, Amélie’s country of residence will tax her worldwide income, but the UK will tax the income derived from activities she has performed in the UK. To avoid the potential double taxation which could occur, Article 15 of the Belgium-UK tax treaty can be applied as this stipulates which country is entitled to tax her employment income.

Under this rule, the country of residency (i.e. Belgium) is entitled to tax. However, an exception to the rule can apply if Amélie’s employment activity is physically exercised in the other Contracting State (i.e. the UK) with this country being entitled to tax the remuneration derived from this activity.

However, it gets complicted as there is an exception to the exception in that even if Amélie’s activity is physically exercised in the other Contracting State (i.e. the UK), her country of residence remains solely competent to tax her income provided the following conditions are met simultaneously:

- Amélie is present in the other Contracting State (i.e. the UK) less than 183 days within any period of 12 months; AND

- Her remuneration is paid by or on behalf of an employer that is not a resident of the other State (i.e. the UK); AND

- The remuneration is not borne by a permanent establishment or a fixed base which the employer has in the other State (i.e. the UK).

As Amélie‘s UK assignment is scheduled for three years, condition ‘a’ is not met and consequently the UK is entitled to tax the remuneration relating to the activities physically performed in the UK. Based on Article 23 of the Belgium-UK tax treaty, Belgium will however provide for treaty relief in order to avoid double taxation.

As the UK will tax the remuneration paid to Amélie by the Belgian employer, the latter is not entitled to withhold the Belgian withholding taxes which, in principle, are to be withheld at source.

Scenario 2: Amélie becomes tax resident in the UK

Under such a scenario, the UK would be solely entitled to tax Amélie’s remuneration provided that she does not exercise part of her activity on Belgian soil. Her Belgian employers would be under no obligation to withhold tax although they are paying her salary, provided that she does not carry out her activity on Belgian soil.

David Gibbs, Corporate Tax Partner at Alliotts in London comments “In either scenario, the Belgian employer needs to operate a UK payroll to ensure PAYE and NICs are deducted from the payments to Amélie. The employer is able to set up and register a payroll even though it is not UK resident nor has any permanent establishment in the UK. In the situation where Amélie becomes UK tax resident, then she will be required to either disclose and pay tax on her worldwide income or elect for the remittance basis and declare only income arising in the UK or remitted to the UK.”

Joerg Scholz, Partner at Scholz GmbH in Duesselforf confirms that as long as Amélie’s regular trips to Germany do not amount to more than 183 days per year in Germany, she will not be considered a German tax resident and will therefore not be required to file a German tax return or make German social security contributions.

In both scenarios, the points below regarding tax on stock options and employment law need to be taken into consideration:

Tax considerations related to stock options

Hunter Norton, Tax Director at Farkouh, Furman & Faccio, New York, comments: “The grant of nonpublicly traded, compensatory stock options to an employee is not a taxable event in the US or UK. However, in Belgium this will depend on whether the Law of March 26, 1999 is applicable or not. If it is applicable, taxation occurs at grant. When Amélie exercises the stock options, in the US and UK, she will need to recognize income if the exercise price is less than the fair market value of the stock. The tax treaty concluded between the US and Belgium or the US and UK (depending on where Amélie is considered to be tax resident) must be consulted to determine which country is entitled to tax her on the benefit derived from the exercise of the stock options. Generally, under the applicable treaty provisions, income from the exercise of stock options is taxable in the state in which the services are performed which give rise to the compensation. Consequently, Amélie may have the ability to determine in which state she is primarily subject to tax based upon where she performs the services attributable to such compensation.”

Employment law issues

Mark Fellows, Partner at Sherrards Solicitors in London, comments that under both scenarios it will be “important that Amélie’s employment contract is clear regarding which country’s legal system and regime for disputes resolution should apply.”

For more information

For more information on Alliott Group/Global Mobility, contact Giles Brake.

Continue reading...

Read the second case study from our expert panel discussion.