India’s Government takes steps to stop tax evasion by issuing Place of Effective Management (PoEM) guidelines

12 June 2017

Pankaj Dave, Senior Partner at B.M. Chatrath & Co in India, provides an update on how the OECD’s Place of Effective Management (PoEM) framework is being implemented in India to determine the residency of companies with global operations.

Pankaj Dave, Senior Partner, B.M. Chatrath & Co

"The intent is not to target Indian multinationals which are engaged in business activity outside India, but instead to target shell companies and companies created for retaining income outside India when real control and management of affairs is located in India."

What is the Place of Effective Management rule?

The PoEM rules entered into effect in India on 1st April 2015 but it is only recently that the Central Board of Direct Taxes (CBDT) issued its own guidelines to test the residential status of a foreign company for tax purposes.

The rules establish specific criteria to determine the place of effective management of a company in situations where the multinational has a presence in two or more jurisdictions but may be using their residential status to avoid paying taxes in India. Where a company has a presence in different jurisdictions, the company would for treaty purposes, be resident in the jurisdiction in which its place of effective management is situated. This test is suggested in the OECD model tax treaty’s tie-breaker rule to determine the residential status of a corporation.

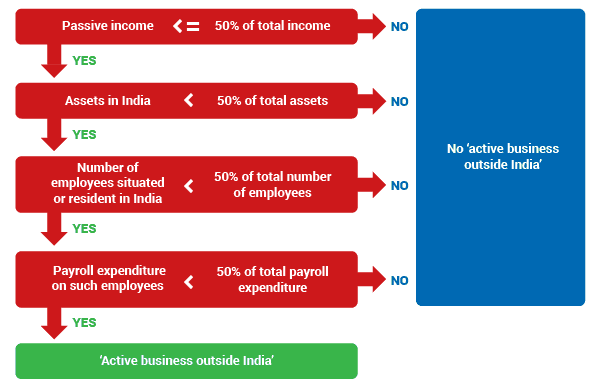

The determination of ‘active business’

Pankaj Dave, Senior Partner at B.M. Chatrath & Co and a member of the alliance's International Tax Services Group comments: “The Place of Effective Management (PoEM) of a company depends on the place where the company is engaged in ‘active business’ and on the conduct of the entity’s board.”

New rules aim to determine where control really lies

The CBDT, via a press release dated January 24, 2017, clarified that the intent is not to target Indian multinationals which are engaged in business activity outside India, but instead to target shell companies and companies which are created for retaining income outside India when real control and management of affairs is located within India.

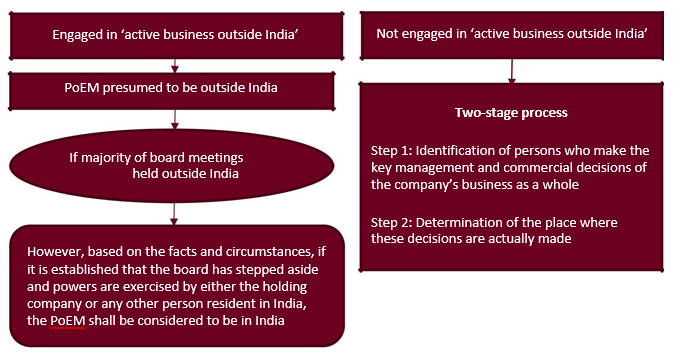

The flow chart below provides a broad overview of the test’s guiding principles in India

Test analysis to determine substance and control

To determine whether or not the company is engaged in ‘active business outside India’, the guiding principles establish the tests below:

The final guidelines also specify:

- Which total income should be taken into consideration for the above test

- Computation of the total assets to be taken into consideration for the test

- The number of employees to be considered for the test

- Computation of the term ‘payroll’, and

- The sources of income to be included as ‘passive income’ – i.e. income from the purchase/sale of goods from/to the company’s associated enterprise and income from royalties, dividends, capital gains, interest or rental income.

Dave explains that place of effective management is defined to mean “a place where key management and commercial decisions that are necessary for the conduct of the business of an entity as a whole are, in substance, made.”

Key definitions to be considered

Passive income

An entity’s passive income is defined as the aggregate of:

- Income from transactions where both purchase and sale of goods is from/to its associated enterprises; and

- Income from royalties, dividends, capital gains, interest or rental income.

Head Office

The head office of a company would be the place where the company's senior management and their direct support staff are located or, if they are located at more than one location, the place where they are primarily or predominantly located.

Senior Management

Furthermore, the senior management of a company would mean the person(s) generally responsible for developing and formulating key company strategies and policies and for ensuring or overseeing the execution and implementation of those strategies on a regular and on-going basis.

When company is not in active business outside India

Where a company is not engaged in ‘active business outside India’, the determination of PoEM would be a two-stage process as shown in the flow chart above. The guidelines provide for the following factors/parameters which shall be taken into account for determining PoEM in such cases:

The location where a company’s board regularly meets and makes decisions may be the company’s place of effective management provided that:

- The board retains and exercises its authority to govern the company; and

- The board does, in substance, make the key management and commercial decisions necessary for the conduct of the company’s business as a whole.

In cases where the board has delegated its authority to committee(s), the location where the members of such committee(s) formulate the key strategies, shall be of relevance for the determination of PoEM.

The involvement of the shareholders to the extent mandated by company laws shall have no relevance in the determination of PoEM; Furthermore, secondary factors such as the place where main and substantial activity of the company is carried out or the place where the accounting records of the company are kept, shall also be taken into consideration.

Other considerations

Certain principles which have to be kept in mind when determining the PoEM of a company, are listed below:

- Any determination of the PoEM will depend upon the facts and circumstances of a given case

- The principles as laid down for determining PoEM are for guidance only

- No single principle will be decisive in itself

- Since ‘residence’ is to be determined for each year, PoEM will also be required to be determined on a year to year basis

- The actual conduct and activities performed by the company over a period of time during the previous year need to be considered

- De facto decisions shall prevail over de jure decisions, and

- If it is determined that PoEM is in India as well as outside India, then PoEM shall be presumed to be in India if it has been mainly/predominantly in India.

Exceptions

The following are not conclusive evidence of the existence of PoEM of a foreign company in India:

- Foreign company being completely owned by an Indian company

- Existence of Permanent Establishment (‘PE’) of a foreign entity in India

- Residence of directors of the foreign company in India

- Presence of local management in India in respect of activities carried out by a foreign company in India, and

- Existence in India of support functions that are preparatory and auxiliary in character.

When a company is engaged in active business outside India

Meetings

The PoEM in the case of a company engaged in ‘active business outside India’ shall be presumed to be outside India if the majority of meetings of the company’s board of directors are held outside India.

Board of Directors

However, if the Board of Directors stands aside and does not exercise its powers, and such powers are instead exercised by the parent company or any other person resident in India, the PoEM shall be considered to be in India. In this regard, it has been clearly stated that should the Board of Directors follow the general and objective principles laid down by the parent entity in respect of all its global companies, and they are not specific to one entity, it shall not be constituted as a case of the Board standing aside.

Administrative safeguards to avoid litigation

To avoid unwarranted litigation, the guiding principles incorporate administrative safeguards. Under these, before proposing to hold a company as a resident of India on the basis of PoEM provisions, but also before initiating any such proceedings, the AO is mandated to seek approval from the Principal Commissioner. This ensures a two-stage check within the department and one would seriously hope that these checks are performed prudently.

Unresolved points

Although the guiding principles provide clarity on several aspects, there is still a lot of ambiguity on certain matters, such as:

- The first limb of the definition of passive income where it states that it includes income from the transactions where both the purchase and sale of goods is from/to its associated enterprises. Clarification will needed on whether the word ‘goods’ means only goods or if it would be deemed to include services

- The second condition stated for ‘active business outside India’ whereby not less than 50% of the total number of employees should be situated or resident in India

- The guidelines seek to clarify that the employees to be considered for the above purpose shall include persons who, though not employed directly by the company, perform tasks similar to those performed by the employees. Again, there may be divergent views on whether a contractual employee, representative agent, professional employer organization, etc. are intended to be covered or not

- The guiding principles are for the determination of PoEM for a company. However, it would be interesting to see if they also bare some relevance in the event of structures set up in a non-corporate form, e.g. a partnership.

Companies the guidelines do not apply to

The press release referred to below clarifies that the guidelines shall not apply to companies with annual turnover or gross receipts of less than INR 50 crores (500 million Indian Rupees = USD 7.8 million).

Conclusion

It will be interesting to see the approach taken by the revenue authorities in cases where the quantitative thresholds, being the tests for fulfilling the ‘active business outside India’ criteria, are met. Just because they meet the quantitative thresholds, one cannot contend with absolute certainty that the PoEM of such companies is not in India. It is advisable to look beyond the quantitative thresholds and to ensure that actual conduct is substantiated by documentation.

It is important to reiterate that the process of determination of PoEM is a factual one driven by substance over form. It is imperative to demonstrate the ‘place’ where decisions are, in substance, taken and to identify the persons actually driving the decision making process.

In view of the considerable implications which may arise from an entity’s PoEM being regarded as in India, one can say with certainty that the CBDT will revert with further clarifications in the form of guidelines/FAQs in the near future.

For international tax advice in India

Contact Mr Pankaj Dave at B.M. Chatrath & Co in India.