Hong Kong passes two-tiered profits tax regime

28 March 2018

New tax law to apply from year of assessment 2018/19

The Inland Revenue (Amendment) (No. 7) Bill 2017 which introduces the two-tiered profits tax regime, passed its third reading in Hong Kong's Legislative Council (Parliament) on 21st March 2018.

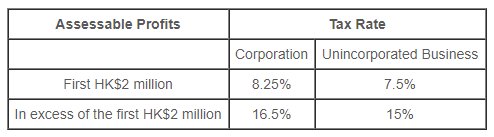

The two-tiered tax rates system (see the table below) will apply starting from the year of assessment 2018/19.

To ensure that small and medium sized enterprises (SMEs) and startups are the real beneficiaries and to prevent income splitting, the new law contains restrictive provisions which prescribe that 'connected entities' can only elect a single entity as being eligible for the two-tiered regime for a given year of assessment. For corporations, a rate of 8.25% applies to corporations on the first HK$2 million of assessable profits, with a rate of 16.5% applying on profits over this HK$2 million threshold (HK$2 million = approx. US$255,000).

For advice in Hong Kong

Contact Ms. Amie Cheung at Lawrence Cheung CPA Company.