Special tax regimes come into force in Belgium

19 April 2022

New special tax regimes for executives and researchers have come into force following legislation published on 31 December 2021. Read this update from Luc Lamy, Partner at accounting firm member Tax Consult in Belgium.

Effective January 1 2022, the circular of 8 August 1983 has been abolished and a new circular of 21 January 2022 introduces a transition period of 2 years for individuals benefitting from the old regime.

GENERAL FRAMEWORK:

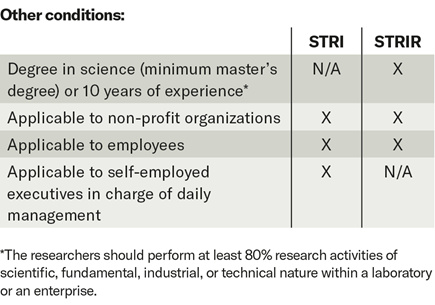

The most significant change is the abolition of the fiction of Belgian tax non-residence. As such, the two new regimes are called the special tax regime for impatriates (hereinafter "STRI") and for impatriate researchers (hereinafter "STRIR").

NEW FEATURES:

All nationality conditions have been removed so that Belgian nationals meeting the conditions listed below will be able to benefit from the new regime. The maximum duration is fixed at 5 years, possibly extended by 3 years. It will be possible to keep the scheme if one changes employer in Belgium.

The individual has to be recruited directly abroad by a Belgian entity (not necessarily part of a multinational group) or a non-profit organization. The individual can also be assigned or transferred within a multinational group.

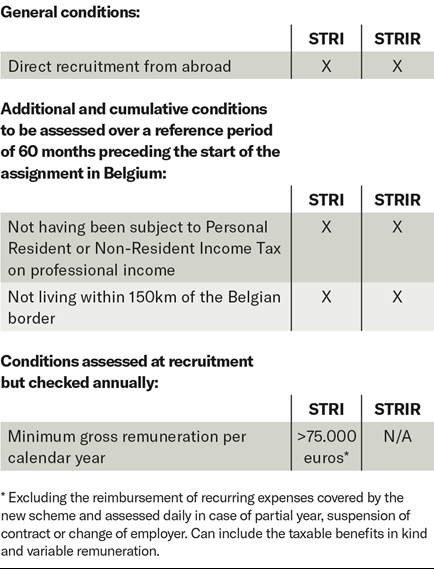

CONDITIONS:

In case of non-compliance with the conditions related to the employer or the salary threshold, the application of the scheme is definitely lost.

BENEFITS:

On top of the remuneration, the employer may reimburse tax free costs proper to the employer up to 30% (capped at 90,000 euros on an annual basis – to be prorated eventually) of the gross annual remuneration.

The reimbursement should be contractually agreed. On top of the 30%,the payment of school fees and certain moving expenses can still be tax free. Installation costs incurred during the first six months may not exceed EUR 1,500. The travel exclusion mechanism has been removed.

The reimbursement of the tax-free costs proper to the employer are exempt from social security contributions.

PROCESS:

A formal request should be filed by the Belgian entity within three months of arrival in Belgium. Any change (i.e. extension, change of employer) will require electronic request to be made. The requests should include the formal agreement of the individual.

NEW OBLIGATIONS:

Under this new scheme, an annual analysis will have to be carried out to verify the salary threshold condition. Furthermore, the new regime will be implemented through rigorous reporting.

TRANSITIONAL PERIOD:

An opt-in procedure is foreseen to allow current foreign executives to benefit from the new regime. Only expats who are less than 5 years under the current regime and who meet the conditions of the new regime may opt-in before 31 July 2022.

Foreign executives not exercising this option or not eligible for the new regime can benefit from the old regime until 31 December 2023. After that date, they will become Belgian tax resident (unless resident of another country).

FOLLOW UP:

An administrative circular and a FAQ are expected soon to provide clarification regarding the practical implementation of the new regimes.

For more information contact Luc Lamy ll@taxconsult.be or Alexandre De Munck adm@taxconsult.be

Luc is also Chair of Alliott Global Alliance's Global Mobility Services Group.

About Tax Consult:

Since 1981, at Tax Consult, we have acquired and developed a wide range of expertise in various sectors, including accounting, Belgian and international taxation as well as the international mobility of executives.

Our practice will help you make timely decisions by providing you with concrete, flexible and effective solutions.

Tax Consult subsidiaries:

HR TAX & International Mobility: provides expertise in individual taxation for executives and business leaders in a national and international context.

TC Accountancy & Advisory: provides accounting and tax expertise to individuals and businesses in a national and international context.